Introduction:

Health insurance is one of the most important forms of financial protection in the United States. With rising healthcare costs, even a short hospital stay can lead to thousands of dollars in medical bills. Having the right health insurance plan helps individuals and families protect themselves from these unexpected expenses while ensuring access to quality care.

This comprehensive guide explains all the major health insurance options available in the USA, including private, employer-based, government, and marketplace plans. Whether you’re self-employed, unemployed, or working full-time, understanding these options will help you choose the best coverage for your needs.

Why Health Insurance Matters in the U.S.?

Healthcare in the United States is largely privatized. Unlike many countries with national healthcare systems, Americans typically access care through private or employer-sponsored insurance. Without coverage, medical services can be prohibitively expensive—making health insurance essential for financial stability and access to care.

For example, a simple emergency room visit might cost $1,000–$3,000, while a three-day hospital stay can exceed $30,000. Health insurance helps pay for these costs through shared risk, premiums, and negotiated provider rates.

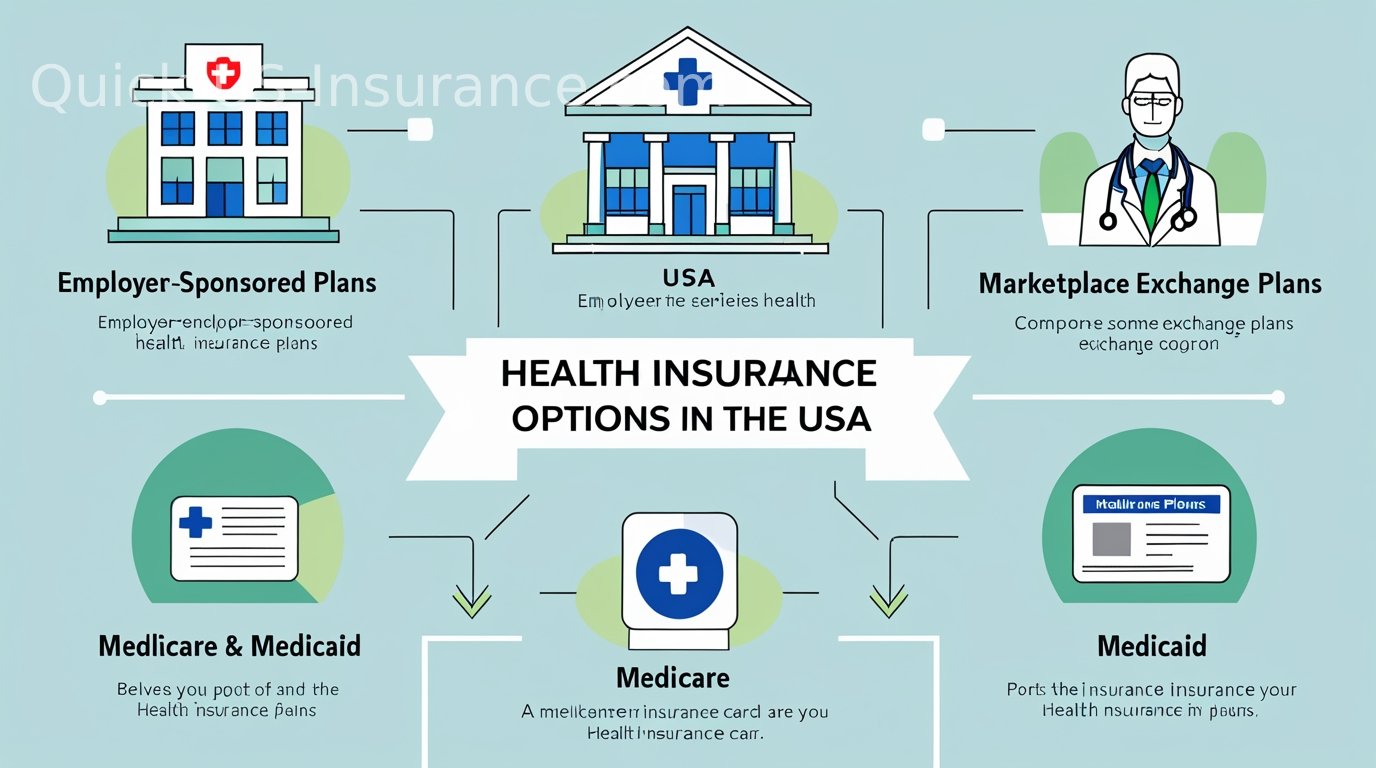

Major Types of Health Insurance in the USA

There are several types of health insurance available to Americans, each designed for specific situations. Here’s a breakdown of the most common options.

1. Employer-Sponsored Health Insurance

Employer-based insurance is the most common type of coverage in the United States, covering roughly half of all Americans. In this system, your employer partners with an insurance company to offer group plans to employees.

Key features:

- Premiums are usually split between the employer and employee.

- Plans often include medical, dental, and vision benefits.

- Coverage is available to dependents and spouses.

- Premiums are paid pre-tax, reducing your taxable income

Pros:

- Lower premiums due to group discounts.

- Broad coverage options.

- Employer handles much of the paperwork.

Cons:

- Limited to your employer’s chosen provider network.

- You may lose coverage if you leave your job.

- Plan flexibility is often limited.

If you lose your job, you may continue employer coverage through COBRA (Consolidated Omnibus Budget Reconciliation Act), but you’ll have to pay the full premium yourself.

2. Individual and Family Health Insurance (Marketplace Plans)

If you’re self-employed or your employer doesn’t offer coverage, you can buy insurance through the Health Insurance Marketplace (HealthCare.gov) or state exchanges created by the Affordable Care Act (ACA).

Plan levels (Metal Tiers):

- Bronze: Lowest premiums, highest out-of-pocket costs.

- Silver: Moderate premiums, moderate coverage (most popular tier).

- Gold: Higher premiums, lower out-of-pocket costs.

- Platinum: Highest premiums, best coverage and lowest costs.

Pros:

- Customizable to your budget and needs.

- Premium tax credits available based on income.

- Coverage regardless of preexisting conditions.

Cons:

- Premiums can still be high for middle-income individuals.

- Limited provider networks in some regions.

3. Government-Sponsored Health Insurance Programs

Several federal and state programs provide health coverage for specific groups.

a. Medicare

Medicare is a federal program primarily for people aged 65 and older, and for younger individuals with certain disabilities.

Parts of Medicare:

- Part A: Hospital insurance (inpatient care).

- Part B: Medical insurance (doctor visits, outpatient care).

- Part C (Medicare Advantage): Private plans offering extra benefits.

- Part D: Prescription drug coverage.

Medicare offers comprehensive protection, but most people also purchase supplemental “Medigap” policies to cover additional costs.

b. Medicaid

Medicaid is a joint federal and state program that provides free or low-cost health coverage to low-income individuals and families.

Eligibility: Varies by state but typically based on income, household size, and disability status. States that expanded Medicaid under the ACA allow more people to qualify.

c. CHIP (Children’s Health Insurance Program)

CHIP offers low-cost coverage for children in families that earn too much to qualify for Medicaid but cannot afford private insurance.

4. Short-Term Health Insurance

Short-term plans offer temporary coverage for a few months to a year. They are ideal for people between jobs or waiting for new coverage to begin.

Pros:

- Affordable monthly premiums.

- Flexible enrollment periods.

Cons:

- Doesn’t cover preexisting conditions.

- Limited benefits (often excludes maternity care, mental health, or prescriptions).

5. Private and Supplemental Insurance

Private health plans are sold directly by insurance companies outside the ACA marketplace. These include high-deductible plans, catastrophic coverage, and supplemental options like critical illness insurance.

Popular supplemental plans:

- Dental and vision insurance.

- Accident insurance.

- Hospital indemnity plans.

These add-ons can be helpful if your main plan doesn’t cover specific needs.

How Health Insurance Costs Work

Every health insurance plan involves several cost factors. Understanding these terms helps you estimate your real expenses:

- Premium: The amount you pay monthly for coverage.

- Deductible: The amount you pay before insurance starts paying.

- Copayment (Co-pay): Fixed fee for services like doctor visits.

- Coinsurance: Percentage you pay after meeting your deductible.

- Out-of-pocket maximum: The most you’ll pay in a year; beyond this, insurance covers 100% of costs.

Example: You have a $1,000 deductible, 20% coinsurance, and $5,000 out-of-pocket limit. After paying $1,000 upfront, you’ll pay 20% of covered costs until you hit $5,000 total spending.

Tips for Choosing the Right Health Insurance Plan

- Assess your healthcare needs. Consider how often you visit doctors and what prescriptions you use.

- Compare total costs, not just premiums. Low monthly premiums might mean higher deductibles.

- Check provider networks. Ensure your preferred doctors and hospitals are covered.

- Review prescription drug coverage. Verify your medications are included in the plan’s formulary.

- Look for financial assistance. Use the ACA marketplace to see if you qualify for tax credits or cost-sharing reductions.

- Use a licensed insurance agent. They can help you compare plans for free.

Popular Health Insurance Providers in the U.S.

Some of the top-rated health insurance companies include:

- Blue Cross Blue Shield (BCBS)

- UnitedHealthcare

- Aetna

- Cigna

- Kaiser Permanente

- Humana

These providers offer a wide range of ACA-compliant and private plans across multiple states.

Health Insurance for Special Groups

- Self-employed: Marketplace or private plans with tax deductions on premiums.

- Students: Campus-sponsored plans or coverage under parents’ insurance until age 26.

- Low-income families: Medicaid or CHIP.

- Seniors: Medicare, Medigap, or Medicare Advantage.

Conclusions:

Health insurance in the United States can seem complex, but once you understand your options, it becomes easier to find a plan that fits your budget and needs. Whether you qualify for an employer plan, Medicare, Medicaid, or marketplace coverage, the key is to compare benefits, costs, and provider networks before deciding.

By taking time to research and understand each type of health insurance, you’re not just buying a policy—you’re investing in your peace of mind and financial protection for the future.