Introduction:

Insurance can seem complicated, but once you understand the basic concepts, it starts to make sense. In the United States, insurance is an essential part of financial planning—it protects individuals, families, and businesses from unexpected losses. Whether it’s a car accident, a house fire, or a medical emergency, insurance is there to help you recover without wiping out your savings.

This article explains how insurance works in the U.S., including key terms, how premiums are calculated, and what happens when you file a claim.

What Is Insurance and Why Does It Exist?

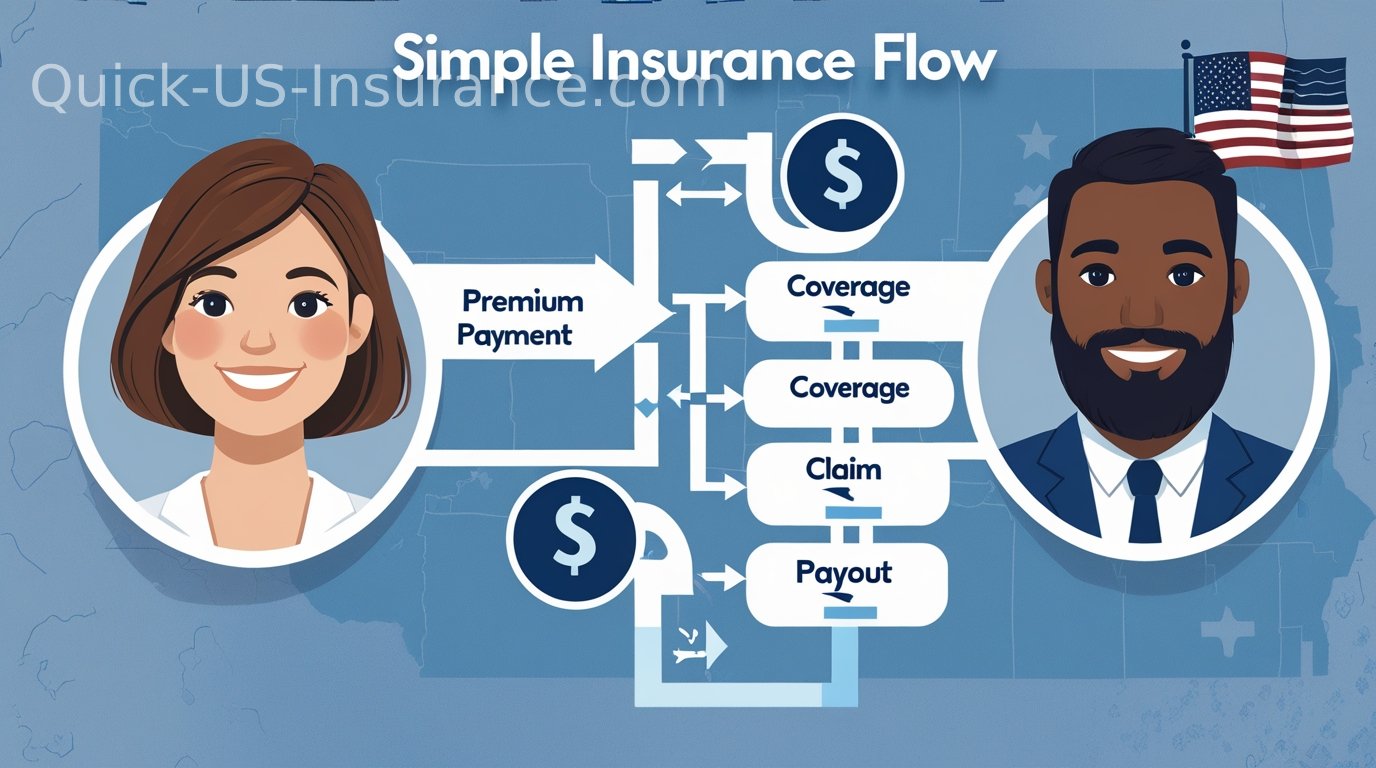

Insurance is a financial contract between you (the policyholder) and an insurance company (the insurer). You pay a monthly or annual premium, and in return, the insurer agrees to cover certain financial losses under specific conditions.

The idea behind insurance is risk management. Everyone faces risks in life, such as accidents, illness, or property damage. Instead of facing these costs alone, people pool their resources through insurance. When one person suffers a loss, the pool covers it using the money contributed by everyone else.

Key Components of Insurance

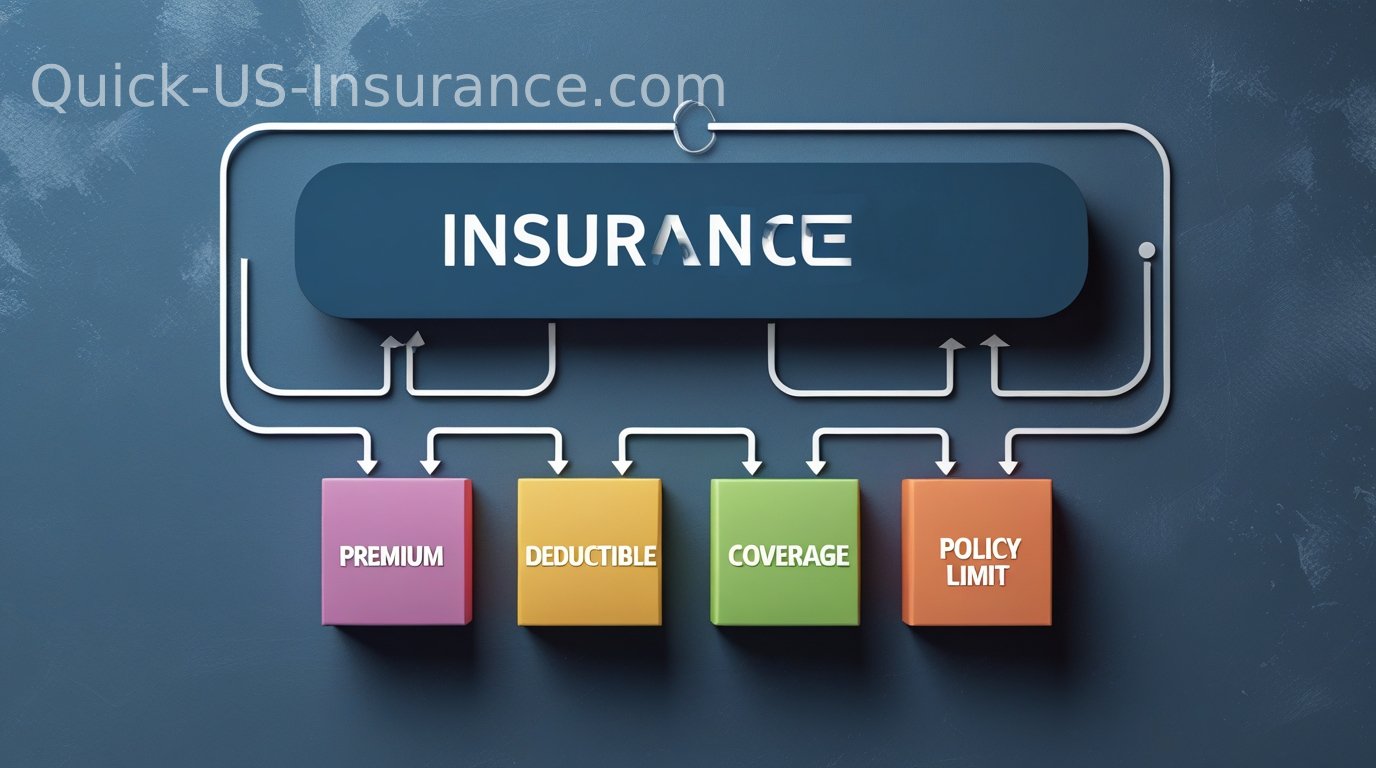

Understanding the main parts of an insurance policy helps you know exactly what you’re paying for and what protection you get.

1. Premiums

A premium is the amount you pay (monthly, quarterly, or yearly) to maintain your insurance coverage. Premiums vary based on factors like your age, location, type of coverage, and risk level. For example:

- A younger, healthy person may pay less for health insurance.

- A driver with a clean record may get cheaper auto insurance.

2. Deductibles

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. If your car repair costs $2,000 and your deductible is $500, you pay $500, and your insurer pays the remaining $1,500.

Policies with higher deductibles usually have lower premiums—and vice versa.

3. Policy Limits

The policy limit is the maximum amount an insurer will pay for a covered loss. For instance, if your homeowner’s insurance has a $250,000 dwelling limit, that’s the most the insurer will pay to rebuild or repair your home after a disaster.

4. Coverage and Exclusions

Your insurance policy specifies what’s covered and what’s not. For example, an auto policy might cover accidents but exclude wear-and-tear damage. Reading the fine print helps you avoid surprises when you file a claim.

How Insurance Companies Assess Risk

Insurance companies use a process called underwriting to decide how risky it is to insure someone. Underwriting involves evaluating factors such as age, health, driving history, property location, and even credit score.

Once the risk is assessed, the company determines your premium. The higher the risk, the higher the cost of coverage.

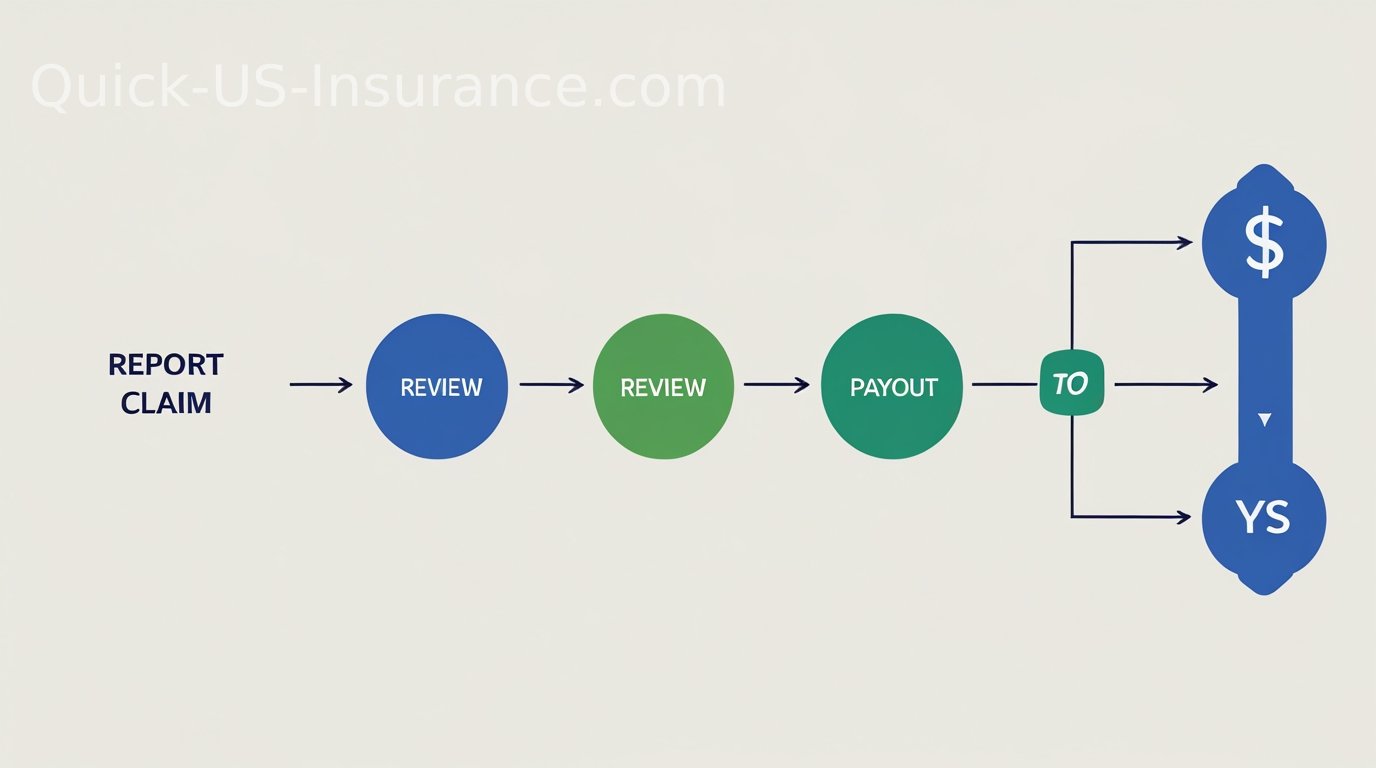

The Claims Process: How You Get Paid

When something goes wrong—a car accident, hospital stay, or house fire—you file a claim. Here’s how it works:

- File a claim: You report the incident to your insurance provider with details and documentation.

- Claim review: The insurer investigates the event, checks the policy, and determines coverage.

- Payment: If approved, the insurer pays for repairs, replacements, or expenses up to the policy limit.

The time it takes to process a claim depends on the type of insurance and the complexity of the situation. Some claims (like minor auto damage) can be settled in days, while others (like major health procedures) may take weeks.

Types of Insurance in the U.S.

Here are the most common types of insurance and how they work:

Health Insurance: Covers medical costs including doctor visits, hospital stays, and prescriptions. In the U.S., health insurance can come from employers, government programs like Medicare and Medicaid, or private plans.

Auto Insurance:

Provides financial protection in case of accidents, theft, or damage. Auto policies often include liability, collision, and comprehensive coverage.Homeowners Insurance:

Covers your house and belongings against damage or loss from events like fire, theft, or storms. It can also include liability protection for injuries on your property.Life Insurance:

Pays out a lump sum to your beneficiaries when you die. It’s designed to replace your income and help your loved ones cover expenses like debts, education, and daily living.Renters and Business Insurance:

Renters insurance protects personal property in a rented home, while business insurance covers companies against liability, property loss, or employee-related risks.

Factors That Affect Your Premiums

Insurance pricing isn’t random—it’s based on data, statistics, and personal risk factors. Common factors include:

- Age: Younger people usually pay less for life and health insurance but more for auto insurance.

- Location: Living in areas prone to floods or theft can raise premiums.

- Lifestyle: Smoking, risky hobbies, or a poor driving record can increase rates.

- Coverage level: More coverage means higher premiums, but also more protection.

How Insurance Companies Stay Profitable?

Insurance companies balance the amount they collect in premiums against what they pay out in claims. They also invest some of their funds to generate additional income. Strong financial performance allows them to handle large-scale disasters, like hurricanes or wildfires, without going bankrupt.

Regulatory agencies such as the National Association of Insurance Commissioners (NAIC) and state insurance departments monitor insurers to ensure they remain solvent and treat policyholders fairly.

Why Understanding Insurance Matters?

Many people buy insurance without really understanding what they’re getting. Knowing how it works helps you:

- Avoid overpaying for coverage you don’t need.

- Recognize when an insurer denies a claim unfairly.

- Compare policies effectively to find the best value.

Conclusions:

Insurance is a cornerstone of financial stability in the U.S. It’s not just about protecting property—it’s about protecting your future. When you understand how premiums, deductibles, and claims work, you can make smarter choices and avoid unpleasant surprises.

Whether it’s health, home, or auto insurance, take time to compare providers, understand your policy, and review it regularly. The better informed you are, the more confident you’ll be in securing the protection you need.